Welcome to the Xporta experience

The following indicators are used in our daily work.

Indice Fletes Promedio Ex Shanghai

Indice Valor Promedio Naves Bulk

The Capital Link Container Index in is comprised of the following 6 companies: Alexander & Baldwin (NYSE: ALEX), Danaos Corp. (NYSE: DAC), Euroseas Ltd. (NASDAQ: ESEA), Global Ship Lease (NYSE: GSL), Horizon Lines Inc. (NYSE: HRZ) and Seaspan Corp. (NYSE: SSW).

lunes, 31 de diciembre de 2012

viernes, 21 de diciembre de 2012

Hapag-Lloyd, Hamburg Süd merger

German carriers Hapag-Lloyd and Hamburg Süd have confirmed that they are exploring the benefits of a possible merger. If the marriage goes ahead, what might it mean for the two companies’ customers and does the move suggest more industry consolidation to come?

On the face of it a straight 50-50 merger looks like a very sound idea with few obvious downsides aside perhaps from some staff attrition where the organisations overlap, such as reefer and Latin American trades.

The cultural fit is good and the service networks complementary. Hapag-Lloyd is predominantly East-West trade oriented as a member of the Grand Alliance (G6 in Asia- Europe) and Hamburg Süd being a non-alliance affiliated North-

South trade specialist. This should not upset the competition authorities.

The merged entity would become the world’s fourth largest container operator with a ship capacity of approximately 1.05 million teu, based on each carrier’s existing fleet. Moreover, the merged company’s orderbook would consist of 32 newbuilds with an aggregate capacity of about 220,000 teu.

Apart from the operational benefits, a merged entity will be able to achieve higher cost efficiencies from procurement, bunkers, chartered vessels, as well as route and network optimisation.Perhaps more importantly, the merged $12 billion revenue company would get better access to both bank debt and the capital market.

The German tryst is not the only merger under discussion. Talks have also been on-going between Chinese carriers Cosco and China Shipping Container Lines (CSCL), leading some to wonder whether these year-end flirtations herald a new round of industry consolidation.

Regardless of how these discussions proceed, Drewry does not believe they will spark off a new wave of M&A activity. Shipping lines do not have the resources to fund such deals, nor the will to take on complex organisational integrations. Besides, valuations will be a challenge, as no target company will appreciate the lack of value an acquirer would be duty bound to attribute to it.

Drewry believes that consolidation in the industry will only take two forms: either corporate failure, or an acceptance that exit from liner shipping is the only sensible strategy; or a defensive merger. The Hapag-Lloyd-Hamburg Süd merger fits the latter. The fact that there have been no significant takeovers in over six years since AP Moller-Maersk purchased P&O Nedlloyd and Hapag-Lloyd bought CP Ships, suggests that there isn’t much of an appetite for such deals.

Fuente Drewry

Fuente Drewry

jueves, 20 de diciembre de 2012

Cosecha de cerezas chilenas afectada por lluvias

Fuente: Portal Fruticola

20 de Diciembre de 2012

20 de Diciembre de 2012

Una primavera compleja para la fruta

El año pasado Chile exportó 14.5 millones de cajas con cerezas. Estimaciones iniciales para la actual temporada se ubicabnn en 16 millones de cajas cifra que, debido a factores climáticos – falta de frío invernal, granizos y lluvias en floración y pinta – se ha reajustado a 10 millones.

Y es que el clima ha mantenido en alerta a los productores de la fruta, los cuales han debido hacer frente a diversas precipitaciones en las zonas productivas.

“Hemos tenido 7 lluvias de flor a cosecha, entonces todo ha ido mermando”, comentó a www.portalfruticola.com Antonio Walker, productor de la fruta. “Hemos tenido una primavera complicada para la cereza”, agregó.

Walker catalogó como “gravísima” la situación que se registra en la VI y VII regiones del país, las cuales se vieron afectadas por un nuevo sistema frontal durante la jornada de ayer y que se presentan en plena época de cosecha de la fruta.

“Estamos viendo los primeros efectos de las lluvias y son muy malos”, dijo. “A la VI región el día de ayer (martes) le quedaba un 10% de fruta y este frente afectó muy fuerte a la VII región y al sur”.

“Nosotros llevábamos un 50% de nuestra cosecha y el efecto que estamos viendo ahora, lo que nosotros tenemos medido en los huertos es que hay un partidura muy importante, realmente grave”, dice, detallando que ya se ve un 25% de partidura en lo que hay en los árboles.

A pesar de los efectos de las precipitaciones el productor señaló que hay ciertas variedades menos afectadas, como es el caso de la Regina, la cual es más resistente a las partiduras. Por otro lado indicó que este sistema frontal va a tener un impacto en la Sweet Heart.

Exportadoras como Exportadora La Purísima Ltda – que concentra su producción en la VI y VII regiones, desde Rancagua hasta Río Claro – nos comentó que están tomando las medidas necesarias para llevar la producción controlada, disminuyendo casi a cero las nuevas pérdidas al minuto de la cosecha luego de las lluvias.

Por factores climáticos, como la falta de horas de frío entre otros, la empresa experimentó una caída del 50% en los volúmenes totales, reflejado desde la floración y por ende en la cosecha.

Actualmente La Purísma maneja las variedades Bing, Lapin, Sweet Heart, Kordia y Regina. La fruta tiene como destino Lejano Oriente, EE.UU y Europa.

Respecto a que pueden esperar los importadores de la fruta, Walker destacó que Chile es muy profesional en lo que hace, por lo que se les puede asegurar que contarán con fruta de “muy buena calidad”.

Por medio de un comunicado la Federación de Productores de Frutas de Chile (FEDEFRUTA) también manifestó su preocupación ante las intensas lluvias en plena época de cosecha en la zona centro sur de Chile.

La entidad informó que mientras en la VI región el adverso clima podría afectar entre un 10% a 20% de la producción, en la VII y VIII región, las pérdidas oscilarían entre un 25% a 80%, según estiman los productores afectados.

Cristián Allendes, presidente de FEDEFRUTA lamentó esta situación y explicó que “era una temporada en la cual los productores tenían muy buenas expectativas. Se estimaba un crecimiento en torno al 10% respecto de la campaña anterior, equivalente a 16 millones de cajas de exportación, sin embargo, las condiciones climáticas ocasionaron serios daños e hicieron que las estimaciones para este temporada disminuyeran hasta los 10 millones de cajas”.

“De la zona cordillerana de San Fernando, hacia el sur, queda bastante cereza por cosechar y ésta ha debido enfrentar, al menos, 50 milímetros de lluvia. Estimamos que en estas zonas, quedan por cosechar unas dos millones de cajas, de las cuales entre un 50% a 60%, podrían verse afectadas”, comentó Hernán Garcés, presidente de Agrícola Garcés.

FEDEFRUTA hizo un llamado a los productores a adoptar todas las medidas necesarias a fin de minimizar en lo posible las pérdidas ocasiones por las inclemencias del clima, especialmente, en los huertos frutales por la amenaza de ataques de hongos ocasionados por la alta temperatura y humedad que se espera se registren en los próximos días en las zonas de producción, al tiempo que el presidente de la entidad expresó su solidaridad con todos aquellos productores que están enfrentando este duro momento y ratificó su apoyo en todas las acciones que se pueden emprender en conjunto las autoridades, la industria frutícola y auxiliar para enfrentar de mejor manera este adverso momento.

“Las cerezas son el principal factor de preocupación. Han sido golpeadas por el clima repetidamente y son naturalmente susceptibles a la intemperie. Las lluvias han hecho que muchos productores hayan perdido 30-40% de su producción y creo que con las lluvias de esta semana podría acabar siendo el 50% de la producción total proyectada a comienzo de la temporada”, comentó Bill Lewis, representante en Chile de Crown Jewels.

En el caso de otras frutas, como los arándanos, Lewis indicó que no se espera un impacto mayor. “En el Valle Central no veo más que un retraso en la cosecha de la fruta por un par de días y la lluvia no tendrá un impacto significativo sobre la fruta”, dijo.

En un plano general Lewis indicó que están muy confiados con la temporada frutícola de Chile, debido a la gran demanda que hay por la fruta chilena. “El consumo de uva en EE.UU es increíble y hay mucho interés.

“Las uvas fluirán por los canales de marketing sin ningún problema, siempre y cuando no presenten problemas de condición”.

Precipitaciones ¿anormales?

Rodrigo Cazanga, encargado del área de producción agrícola y clima del CIREN, explicó a www.portalfruticola.com que el fenómeno climatológico que ha afectado las últimas semanas a la zona centro-sur de Chile se debe principalmente a la retirada del Fenómeno de La Niña, el cual estuvo presente por casi cuatro años y mantuvo los niveles de precipitaciones por debajo del promedio en un año normal.

“La llegada del Fenómeno de El Niño, que comenzó durante el invierno ha hecho que esta temporada hayan mayores precipitaciones que en los años anteriores, sin embargo, este aumento en las precipitaciones, que muchos lo ven como algo inusual, no lo es tanto, ya que aún con estas lluvias “inusuales”, seguimos estando bajo el promedio de un año normal”.

Cazanga nos explica que el equivalente al promedio de un año normal es la media de las precipitaciones de los últimos 30 años.

“Si uno entonces ve esas cifras por ejemplo en Curicó es normal que caigan lluvias del orden de 20 mm sólo en diciembre y en Temuco que las lluvias sean mayores en diciembre, con un promedio de 50 mm”.

“Esto que está ocurriendo es sólo un acercamiento a las condiciones normales que deberían darse en el país. Aún no alcanzamos el promedio de precipitaciones del año normal, por lo que no es algo inusual”, detalla.

Respecto a la agricultura, el experto comenta que esta situación no es la ideal para la época de cosecha de frutos como el arándano y las cerezas.

“Lo que está pasando en cuanto a clima, es que este va a ser un año que se aproxima a las condiciones normales, lo cual no es lo más óptimo del punto de vista de producción agrícola de frutales que se cosechan en esta época”.

“Para los agricultores las condiciones de clima seco en primavera seca eran muy convenientes para la cosecha y la calidad de la fruta, ya que al no haber humedad ni agua líquida sobre la superficie de los frutos, no había partidura ni desarrollo acelerado de hongos, pero esta era una condición climática anormal”.

“Lo que van a tener que hacer ahora es aumentar el número de aplicaciones de fungicidas y tratar de manejar de mejor forma los momentos propicios de cosecha”, dice, por ejemplo a través de una coordinación con los trabajadores.

De mantenerse estas condiciones climáticas, Cazanga dice que lo más probable es que la calidad de los frutales se vea afectada, por enfermedades o partiduras, especialmente en las cerezas.

lunes, 17 de diciembre de 2012

Weekly Report of China Export Container Transport Market

CCFI Commentary in Issue 48, 2012

Rates Dived Widely since Weak Demand

As Christmas shopping spree starts in China and western markets, China exports box market has headed into slack season in overall.

Without volume support, utilization remained at a low level and rates on major trades continued to dive. On the Persian Gulf and Red Sea service, the rate surged significantly last week, but plunged this week.

On Dec.7, the China Containerized Freight Index (CCFI) issued by Shanghai Shipping Exchange (SSE) stood at 1106.28 points, down by 2.1% from last week; while the Shanghai Containerized Freight Index (SCFI) marked 1052.99 points, down by 2.8% from last week.

On the Europe trade, volume shrank during the slack season, leaving the average slot utilization rate of service from Shanghai to Europe just around 70% with weakening spot rates.

In contrast, at least one carrier engaging in Mediterranean service axed massive capacity this week, helping the utilization rebound to over 85%.

Nevertheless, oversupply is still out there and rates continued to decline this week, hitting as low as $600/TEU in some cases.

On Dec.7, the CCFI showed that the freight index of Europe and Mediterranean service marked at 1412.29 points and 1177.11 points, respectively down by 3.0% and 5.6% against last week.

To restore rates, many lines are planning to lift rates since from mid-Dec. with an increase of $500/TEU

The impact of the strike in USWC ports that lasted one week have eased, so volume are gradually picking up on the North America service.

In the past two week, the average slot utilization rate for the USWC service remained at around 80%.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USWC stood at $2019/FEU, down by 1.3% from a week ago.

According to statistics, trading volume in LA-LB ports accounts for 40% of the total volume in U.S. Affected by the strike, ships in laden were unable to call terminals to discharge boxes, which resulted in economic losses estimated $1billion per day.

Volume on the USEC service was stronger than that on USWC service, with the average slot utilization rate hitting above 80%.

Rate decline slowed on the North America service, and carriers have to delay rate adjustment plan as the approach of rate increase in mid-Dec.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USEC stood at $3071/FEU, almost unchanged from last week.

According to insiders, although the end of strike in USWC ports, workers in USEC ports are planning to strike at the end of this month.

On the Australia and New Zealand service, due to the low demand during the slack season and carriers’ reluctance to contract capacity, the average slot utilization rate of this service fell below 80% and rates declined at a quicker pace this week.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of Australia and New Zealand marked $954/TEU, down by 4.7% against a week ago. This compared to a decline of 3.3% last week. The Australia and New Zealand component of CCFI also fell, down by 1.6% from last week to1072.73 points.

Carriers collectively lifted rates for boxes from Asia to Persian Gulf last week, despite the insufficient cargo. The achievement of last week’s rate increase was partly eroded with rate of utilization hovering around 60%.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports in this region plummeted by 13.2% to $749/TEU.

Volume on the South America trade shrank this week. Some carriers started to carry on winter capacity adjustment. As a result, the average slot utilization rate of ships leaving Shanghai for ports in South America rebounded back above 80% with falling spot rates.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of South America dropped by 1.9% to $2055/TEU. The South America component of the CCFI saw a 1.1% week-on-week decrease to 1097.28 points.

On the Japan trade, volumes out of Shanghai rose moderately this week, with the average slot utilization rate of ships from Shanghai to Japan standing above 75% with stable spot rates.

On Dec.7, the CCFI showed that the freight index of this service quoted at 790.90 points, almost unchanged from last week.

Rates Dived Widely since Weak Demand

As Christmas shopping spree starts in China and western markets, China exports box market has headed into slack season in overall.

Without volume support, utilization remained at a low level and rates on major trades continued to dive. On the Persian Gulf and Red Sea service, the rate surged significantly last week, but plunged this week.

On Dec.7, the China Containerized Freight Index (CCFI) issued by Shanghai Shipping Exchange (SSE) stood at 1106.28 points, down by 2.1% from last week; while the Shanghai Containerized Freight Index (SCFI) marked 1052.99 points, down by 2.8% from last week.

On the Europe trade, volume shrank during the slack season, leaving the average slot utilization rate of service from Shanghai to Europe just around 70% with weakening spot rates.

In contrast, at least one carrier engaging in Mediterranean service axed massive capacity this week, helping the utilization rebound to over 85%.

Nevertheless, oversupply is still out there and rates continued to decline this week, hitting as low as $600/TEU in some cases.

On Dec.7, the CCFI showed that the freight index of Europe and Mediterranean service marked at 1412.29 points and 1177.11 points, respectively down by 3.0% and 5.6% against last week.

To restore rates, many lines are planning to lift rates since from mid-Dec. with an increase of $500/TEU

The impact of the strike in USWC ports that lasted one week have eased, so volume are gradually picking up on the North America service.

In the past two week, the average slot utilization rate for the USWC service remained at around 80%.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USWC stood at $2019/FEU, down by 1.3% from a week ago.

According to statistics, trading volume in LA-LB ports accounts for 40% of the total volume in U.S. Affected by the strike, ships in laden were unable to call terminals to discharge boxes, which resulted in economic losses estimated $1billion per day.

Volume on the USEC service was stronger than that on USWC service, with the average slot utilization rate hitting above 80%.

Rate decline slowed on the North America service, and carriers have to delay rate adjustment plan as the approach of rate increase in mid-Dec.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USEC stood at $3071/FEU, almost unchanged from last week.

According to insiders, although the end of strike in USWC ports, workers in USEC ports are planning to strike at the end of this month.

On the Australia and New Zealand service, due to the low demand during the slack season and carriers’ reluctance to contract capacity, the average slot utilization rate of this service fell below 80% and rates declined at a quicker pace this week.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of Australia and New Zealand marked $954/TEU, down by 4.7% against a week ago. This compared to a decline of 3.3% last week. The Australia and New Zealand component of CCFI also fell, down by 1.6% from last week to1072.73 points.

Carriers collectively lifted rates for boxes from Asia to Persian Gulf last week, despite the insufficient cargo. The achievement of last week’s rate increase was partly eroded with rate of utilization hovering around 60%.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports in this region plummeted by 13.2% to $749/TEU.

Volume on the South America trade shrank this week. Some carriers started to carry on winter capacity adjustment. As a result, the average slot utilization rate of ships leaving Shanghai for ports in South America rebounded back above 80% with falling spot rates.

On Dec.7, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of South America dropped by 1.9% to $2055/TEU. The South America component of the CCFI saw a 1.1% week-on-week decrease to 1097.28 points.

On the Japan trade, volumes out of Shanghai rose moderately this week, with the average slot utilization rate of ships from Shanghai to Japan standing above 75% with stable spot rates.

On Dec.7, the CCFI showed that the freight index of this service quoted at 790.90 points, almost unchanged from last week.

viernes, 7 de diciembre de 2012

CCFI Commentary Issue 47, 2012

| Weekly Report of China Export Container Transport Market Weak Demand Forced Carriers to Mull Year-End Rate Restoration China exports box market felt the chills of winter season this week. To maintain the utilization, carriers widely used low-rate strategy to canvass cargoes. However, such efforts can’t reverse the downside. Therefore, lines are mulling rate increases on many trade lines to gain the lost ground. The Persian Gulf and Red Sea service took the lead, where rates surged by over $200/TEU in average this week. On Nov. 30, the China Containerized Freight Index (CCFI) issued by Shanghai Shipping Exchange (SSE) stood at 1,129.90 points, down by 1.3% from last week; while the Shanghai Containerized Freight Index (SCFI) quoted at 1,082.82 points, almost unchanged from last week. Demand fell sheer on the Europe and Mediterranean service during the slack season. Moreover, the decline of demand well outpaced the contraction of capacity. The average slot utilization rate of ships leaving Shanghai for ports in North Europe struggled to maintain 70%. The utilization was even as low as 60% on the Mediterranean service. Carriers’ announcement of capacity cut this week failed to stop the rates from falling back to the level before increased ahead of November. On Nov. 30, the CCFI showed that the freight index of Europe and Mediterranean service marked at 1,456.03 points and 1,246.80 points, respectively down by 2.9% and 3.5% against last week. Considering the weak condition, some carriers postponed the rate increase plan by Mid-Dec. In the North America service, the labor union of office staffs in LA-LB ports organized strike on Nov.28 local time with the support of local stevedores, which disrupted most terminal operations in two ports. Many lines had to adjust the schedule temporarily. The average slot utilization rate of the USWC service quoted at below 80% this week and rates continued to drop. On Nov. 30, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USWC stood at $2,046/FEU, down by 2.1% from a week ago. Liftings on the USEC service were also weak, where the average slot utilization rate hit around 80% and rates kept slip. On Nov. 30, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USEC tumbled by 1.5% to $3,099/FEU. The Australia and New Zealand service is about to head into the slack season, where the average slot utilization rate reported at 90% below as demand declined. Rates went down this week again in a slower pace. On Nov. 30, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of Australia and New Zealand marked at $1,001/TEU, down by 3.3% against a week ago. On the Persian Gulf and Red Sea service, demand slid further as the social unrest in destination market. The average slot utilization rate decreased to around 60% this week. To restore rates, most carriers carried out the rate increase plan. As a result, the booking rates hiked over $200/TEU in average this week. On Nov. 30, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports in this region surged by 37.9% to $863/TEU. Exports of Christmas goods have almost finished on the China/South American trade. Individually, the average slot utilization rate of the SAWC service slid to about 90%. The SAEC service was relatively robust, with the utilization still staying 90% above. On Nov. 30, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of South America dropped by 1.5% to $2,094/TEU, Volume from Shanghai to Japan ports rose this week. Ships leaving Shanghai for Japan can be 70%-plus filled. Rates fluctuated slightly this week. On Nov. 30, the CCFI showed that the freight index of this service stood at 789.02 points, down by 1.4% comparing with last week. |

miércoles, 5 de diciembre de 2012

CCFI Commentary in Issue 46, 2012

| Weekly Report of China Export Container Transport Market SCFI dived during the slack season China exports box market witnessed another sluggish week. As the traditional slack season comes, carriers cut rates aggressively to maintain the utilization, which dragged rates down. On Nov. 23, the China Containerized Freight Index (CCFI) issued by Shanghai Shipping Exchange (SSE) stood at 1,144.98 points, down by 0.7% from last week; while the Shanghai Containerized Freight Index (SCFI) dived by 5.1% to 1,077.34 points. Despite active capacity cut by lines, such moves failed to bring a relief on the Europe trade. Demand was slack when winter came in the Northern Hemisphere. The average slot utilization rate just hovered at around 70% this week. Meanwhile, rates went down further, which have fallen by $400/TEU since the beginning of this month. On Nov. 23, the CCFI showed that the freight index of Europe service stood at 1,499.28 points, down by 1.3% from last week. On the Mediterranean market, demand growth was dented by the seasonal factor and weak economy in Southern Europe. To cope with the lack of volume during the winter, lines strengthened the management on capacity, for example, CKYH alliance announced that its members would suspend 7 Asia/Mediterranean sailings from Nov to mid-Jan next year. It collided with G6’s similar move to carry on slow steaming on 3 routes connecting Asia and North Europe /Mid East. CKYH’s cut moved about 21% of the total capacity the alliance deployed on the Mediterranean service, which helped the average slot utilization rate of this tradelane rebounded back to around 70%. On Nov. 23, the CCFI showed that the freight index of Mediterranean service marked at 1,292.30 points, down by3.4% from last week. On the North America service, demand was slack as the trade had head into slack season. The average slot utilization rate for the USWC service was less than 80% and rates continued to slide. On Nov. 23, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USWC stood at $2,089/FEU, down by 6.1% from last week. It is said some lines started to launch slow steaming to absorb excess capacity. The USEC service fared better as lines took stricter discipline on capacity on this service. However, the average slot utilization rate still recorded a marginal decline this week, standing at around 85%. Rates also declined. On Nov. 23, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USEC stood at $3,146/FEU, down by 3.1% from last week. TSA members decided to lift rates by $400/FEU from next month as they tried to laid a firm foundation for the upcoming annual contract negotiation. On the Australia and New Zealand service, demand was hit by seasonal factors and strike prevailing in New Zealand ports, where the average slot utilization rate fell below 90% and rates slumped this week. On Nov. 23, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of Australia and New Zealand stood at $1,035/TEU, 4.3% lower than last week. Political turbulences continued to affect the volume on the Persian Gulf and Red Sea service, where the average slot utilization rate declined to around 60% and rates sagged. On Nov. 23, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of this region dropped by 11.8% to $626/TEU, the lowest level in last 3 months. This compared to the decline of 3.5% last week. Lifting on the Japan service grew firmly this week. Ships leaving Shanghai for Japan can be 70%-plus filled. Rates remained stable. On Nov. 23, the CCFI showed that the freight index of this service stood at 776.42 points, almost unchanged from last week. |

lunes, 26 de noviembre de 2012

CCFI Commentary in Issue 45, 2012

| Weekly Report of China Export Container Transport Market Indices went down amid sluggish demand Demand on major east-west bound trades dived and rates went south further, that was the general picture of China exports box market this week. On Nov. 16, the China Containerized Freight Index (CCFI) issued by Shanghai Shipping Exchange (SSE) stood at 1,152.85 points, down by 0.3% from last week; while the Shanghai Containerized Freight Index (SCFI) tumbled by 4.9% to 1,134.98 points. The Europe service has head into the slack season, where demand continued to shrink this week. Although major lines took means to cut capacity, the over-tonnage situation didn’t improve thoroughly, and the average slot utilization rate was less than 80%. Regionally speaking, lifting out of East China and South China declined at a slower pace than North China, and the average slot utilization rate can still remain at around 80%. However, lifting out of North China fell sharply because of its less various export goods that is vulnerable to volatile market. The average slot utilization rate slid to about 75% this week. Rates for some China/Europe voyages plunged up to $300/TEU, while most shrank about $100/TEU. On Nov. 16, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of Europe quoted at $1,225/TEU, down by 11.4% from last week. This compared to decline of 7.2% last week. The Mediterranean service was hit harder, where the average slot utilization rate went down to 75%. In some cases, ships can only be 65% filled. Rates for individual voyages have been below the bottom line since this month. The deteriorated supply/demand equilibrium made rates plummeted from a low base this week. On Nov. 16, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of Mediterranean plunged by 10.4% to $856/TEU, almost falling back to the level before the significant increase in March. Given the current unsustainable rate level, lines plan to increase rates significantly next month. It was said that some lines had announced they would lift rates by $500-$600/TEU since Dec.15. Demand spiraled down this week on the North America trade, where the average slot utilization rate remained at around 90%. Carriers cut rates aggressively to compete for more cargos, and rate level continued to fall. The planned rate increase on Dec.1 has been postponed to mid-Dec. On Nov. 16, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of USWC and USEC stood at $2,224/FEU and $3,246/FEU, respectively down by 3.7% and 2.2% from last week. On the Australia and New Zealand service, market became quiet this week as almost all Christmas goods had been shipped before last week. Demand dropped, with the average slot utilization rate of this service slipping to around 90%. Rates continued to go down. On Nov. 16, the SCFI showed that the freight rate (covering seaborne surcharges) of service from Shanghai to base ports of Australia and New Zealand stood at $1,081/TEU, 3.5% lower than last week. Economy in Middle East worsened because of the continuous political turbulences in this region, which resulted that demand has been falling sharply since the beginning of this month on the Persian Gulf and Red Sea service. Separately, the average slot utilization rate of the Persian Gulf service slid to about 60% and rates dived as lines added massive capacity to this trade previously. In contrast, some carriers withdrew some sailings on the Red Sea service, which brought a relief to this oversupplied market, with the average utilization at some 70%. Rate decrease slowed this week. On Nov. 16, the CCFI showed that the freight index of Persian Gulf and Red Sea service marked 990.25 points, down by 5.0% from last week. Volume rose slightly this week. Ships leaving Shanghai for Japan can be 70%-plus filled. Rates kept stable. On Nov. 16, the CCFI showed that the freight index of this service tumbled by 1.0% to 782.97 points. |

lunes, 20 de agosto de 2012

Weekly Report of China Export Container Transport Market

(CCFI Commentary in Issue 32, 2012)

Weak Demand Caused Composite Indexes Fell Moderately

China export box market continued on the downward trend this week. Volumes in many oceangoing services were weak to grow, and the composite indexes slip further. On August 10, the China Containerized Freight Index (CCFI) and Shanghai Containerized Freight Index ( SCFI), issued by Shanghai Shipping Exchange (SSE), reported at 1,273.51 and 1,363.41 points, down by 0.8% and 0.4% from last week respectively.

In the Europe trade, affected by the depressed economy in the Euro zone, demand was not improved remarkably and continued to be weak despite in the traditional peak season. Although carriers began to limit capacity by canceling some voyages temporarily, the oversupply of capacity has not been changed reversely. The average slot utilization in this service hovered at around 85%. Furthermore, for the lack of insufficient cargo sources, carriers failed to raise spot freight rates in early August. Spot rates dropped this week after rebound in early August, with the present rate lower than the level before being raised. On August 10, the CCFI showed the freight index of this service marked at 1,831.36 points, down by 2.1% month on month.

Volume was weaker in the Mediterranean service. The depressed consumption confidence of residents in the receipt place brought demand to fall further in the west- Mid, where the average slot utilization declined to around 80%, with spot rate decreasing ranged from $50 to $75 per TEU; Affected by many factors in the receipt place, such as Ramandan, geopolitical chaos, transport demand shrinked further in the east-Mid and North Africa services, where the average slot utilization kept at around 75%, and the spot freight rate fell in gerneral, ranging from $75 to $150 per TEU. On August 10, the CCFI showed the freight index of this service marked at 1,849.42 points, down by 9.4% compared with the same period last month.

Demand climbed up steadily in the North America service, where the average slot utilization kept above 90%, with some above 95%. Rates went in different trends. On one hand, encouraged by the improved situation of demand and supply, some carriers who had not lift rate began to raise rates, up by around $300/FEU in the USWC service and $500/FEU in the USEC service; on the other hand, in order to stable cargo sources, some carriers who had hiked rates began to decrease rates in some extent from $50 to $100 per FEU. On August 10, the CCFI, showing the freight rates (including freight and seaborne) in the USWC and USEC services, reported at $2,782 /FEU and $4,098 /FEU, down by 4.2% and 2.7% from last week respectively.

In the Australia and New Zealand service, volume declined firmly. Recently, carriers retrieved the control on capacity gradually, which led to the aveage slot utilization below 80% and rate down further. On August 10, the SCFI, showing the freight rate (including freight and seaborne) in this service, reported at $784/ TEU, down by 3.1% from last week.

volume was stable in the Persian Gulf service, where the average slot utilization kept at around 60%. Affected by the serious unbalanced situation of supply and demand, rate declined in a fast speed, with the lowest below $700/ TEU. On August 10, the CCFI, which showed the freight index of the Persian Gulf service, reported at 1,204.09 points, down by 9.1% weekly, or declined 16.9% monthly.

In the South America service, transport demand climbed up, as encouraged by the improved demand on traders in the emerging markets like Brazil. However, a large scale of capacity was added by carriers since July, which led to the unbalanced situation of supply and demand in a short time. The average slot utilization slip to around 85%, with rate falling further. On August 10, the SCFI, showing the freight rate ( including freight and seaborne ) , reduced by 2.4% against last week to1,926$/TEU.

In the Japan service, volume was stable this week, where the average slot utilization kept at around 75%. Rate declined slightly. On August 10, the CCFI, showing the freight index of this service, reported at 742.18 points, down by 0.6% from last week.

Weak Demand Caused Composite Indexes Fell Moderately

China export box market continued on the downward trend this week. Volumes in many oceangoing services were weak to grow, and the composite indexes slip further. On August 10, the China Containerized Freight Index (CCFI) and Shanghai Containerized Freight Index ( SCFI), issued by Shanghai Shipping Exchange (SSE), reported at 1,273.51 and 1,363.41 points, down by 0.8% and 0.4% from last week respectively.

In the Europe trade, affected by the depressed economy in the Euro zone, demand was not improved remarkably and continued to be weak despite in the traditional peak season. Although carriers began to limit capacity by canceling some voyages temporarily, the oversupply of capacity has not been changed reversely. The average slot utilization in this service hovered at around 85%. Furthermore, for the lack of insufficient cargo sources, carriers failed to raise spot freight rates in early August. Spot rates dropped this week after rebound in early August, with the present rate lower than the level before being raised. On August 10, the CCFI showed the freight index of this service marked at 1,831.36 points, down by 2.1% month on month.

Volume was weaker in the Mediterranean service. The depressed consumption confidence of residents in the receipt place brought demand to fall further in the west- Mid, where the average slot utilization declined to around 80%, with spot rate decreasing ranged from $50 to $75 per TEU; Affected by many factors in the receipt place, such as Ramandan, geopolitical chaos, transport demand shrinked further in the east-Mid and North Africa services, where the average slot utilization kept at around 75%, and the spot freight rate fell in gerneral, ranging from $75 to $150 per TEU. On August 10, the CCFI showed the freight index of this service marked at 1,849.42 points, down by 9.4% compared with the same period last month.

Demand climbed up steadily in the North America service, where the average slot utilization kept above 90%, with some above 95%. Rates went in different trends. On one hand, encouraged by the improved situation of demand and supply, some carriers who had not lift rate began to raise rates, up by around $300/FEU in the USWC service and $500/FEU in the USEC service; on the other hand, in order to stable cargo sources, some carriers who had hiked rates began to decrease rates in some extent from $50 to $100 per FEU. On August 10, the CCFI, showing the freight rates (including freight and seaborne) in the USWC and USEC services, reported at $2,782 /FEU and $4,098 /FEU, down by 4.2% and 2.7% from last week respectively.

In the Australia and New Zealand service, volume declined firmly. Recently, carriers retrieved the control on capacity gradually, which led to the aveage slot utilization below 80% and rate down further. On August 10, the SCFI, showing the freight rate (including freight and seaborne) in this service, reported at $784/ TEU, down by 3.1% from last week.

volume was stable in the Persian Gulf service, where the average slot utilization kept at around 60%. Affected by the serious unbalanced situation of supply and demand, rate declined in a fast speed, with the lowest below $700/ TEU. On August 10, the CCFI, which showed the freight index of the Persian Gulf service, reported at 1,204.09 points, down by 9.1% weekly, or declined 16.9% monthly.

In the South America service, transport demand climbed up, as encouraged by the improved demand on traders in the emerging markets like Brazil. However, a large scale of capacity was added by carriers since July, which led to the unbalanced situation of supply and demand in a short time. The average slot utilization slip to around 85%, with rate falling further. On August 10, the SCFI, showing the freight rate ( including freight and seaborne ) , reduced by 2.4% against last week to1,926$/TEU.

In the Japan service, volume was stable this week, where the average slot utilization kept at around 75%. Rate declined slightly. On August 10, the CCFI, showing the freight index of this service, reported at 742.18 points, down by 0.6% from last week.

viernes, 6 de julio de 2012

Thursday, July 5, 2012

Europe’s Crisis is Re-Emerging

By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

As I‘ve been saying over the last few days, last week’s EU summit providedEurope

with some political success but actual deliverables are some time off. According to the Finnish PM at least a year. There is already rumbling from a number of countries, including Germany, about what exactly was and wasn’t decided last Friday morning and my suspicious are, as we’ve seen many times before, that final outcomes will be some 17, or 27, headed beast built on layers of political compromise.

In the meantime the implementation of austerity policy across the periphery, and now France it seems, continues to lead to a slowing economy across the monetary union.

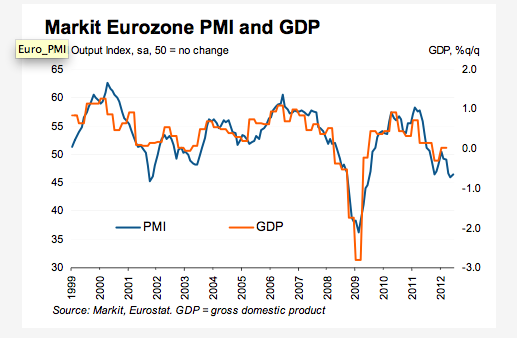

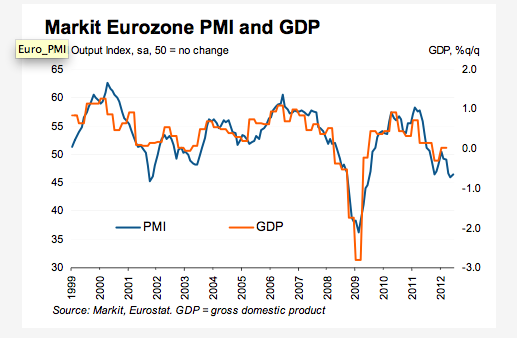

Overnight we had yet another tranche of PMI data that once again highlighted the same downward trend.

Detailed reports of individual country’s June service’s PMI were also released with much the same story. Germany‘s service sector stagnated while its business outlook deteriorated markedly. French services activity remained in contraction, declining at slower pace, but business expectations fell to 39-month low. Italy saw further marked decreases in services activity while job shedding accelerated. Spain saw a sharp reduction in business activity, and finally, Ireland‘s service sector activity continued to fall although at nothing like the pace of the southern economies.

So its a very grim picture across the board as this collection of charts shows.

Last December I wrote a follow-up piece on the risks in the French economy in which I stated:

With peripheral yields rising once again one wonders what Europe can come up with next. Maybe the ECB will have some surprises in todays’ monetary policy decisions. It had better.

As I‘ve been saying over the last few days, last week’s EU summit provided

In the meantime the implementation of austerity policy across the periphery, and now France it seems, continues to lead to a slowing economy across the monetary union.

Overnight we had yet another tranche of PMI data that once again highlighted the same downward trend.

EuroZone composite PMI – June 2012 Final

Eurozone PMI rises in June but still signals steep rate of contraction

Final Eurozone Composite Output Index: 46.4 (Flash 46.0, May 46.0)The Eurozone economic

Final Eurozone Services Business Activity Index: 47.1 (Flash 46.8, May 46.7)

Near-record fall in service sector confidencedownturn extended into a fifth consecutive month in June, as the debt and political crises continued to have an adverse impact on both the manufacturing and service sectors.

At 46.4 in June, the Markit Eurozone PMI Composite Output Index was higher than both May’s reading of 46.0 and the earlier flash estimate of 46.0, but still remained deep in contraction territory. The average reading for Q2 2012 was the lowest for three years as a result.

Rates of decline eased marginally in both services and manufacturing, but both sectors have seen the strongest quarterly contractions for three years in the second quarter.

The spreading of the economic malaise from the periphery of the currency union to its core continued in June. German output contracted at the fastest rate in three years, and France also saw a further decline (albeit slower than in May). Italy and Spain, meanwhile, remained in deep recessions.

Detailed reports of individual country’s June service’s PMI were also released with much the same story. Germany‘s service sector stagnated while its business outlook deteriorated markedly. French services activity remained in contraction, declining at slower pace, but business expectations fell to 39-month low. Italy saw further marked decreases in services activity while job shedding accelerated. Spain saw a sharp reduction in business activity, and finally, Ireland‘s service sector activity continued to fall although at nothing like the pace of the southern economies.

So its a very grim picture across the board as this collection of charts shows.

Last December I wrote a follow-up piece on the risks in the French economy in which I stated:

.. France would be next after Italy in the contagion breakdown because of its macroeconomic metrics. High levels of public and private debt, a long running negative trade balance and current account deficit, stalling industrial production, GDP and employment along with significant banking sector exposure to the periphery all add up to a fairly risky predicament. This is certainly not a country that could take on a strict austerity regime without causing itself some significant short-to-medium term economic damage because it is obvious from the metrics that the private sector has been borrowing from both the external and government sectors for a long period of time.It appears from the data that Italy is now well within the embrace of the crisis and that France is heading in the same direction. Given France’s main trading partners are Germany, Italy and Spain it is very unlikely that a campaign of government austerity is going to reverse that trend, in fact all things being equal, I would expect acceleration.

With peripheral yields rising once again one wonders what Europe can come up with next. Maybe the ECB will have some surprises in todays’ monetary policy decisions. It had better.

Topics: Economic fundamentals, Guest Post

martes, 22 de mayo de 2012

CCFI Commentary Issue 18, 2012

| Weekly Report of China Export Container Transport Market (CCFI Commentary in Issue 18, 2012) Demand and Comprehensive indices stay stable China export box market went steady this week, with demand remaining stable on key oceangoing routes and comprehensive indices inched up slightly. On May 4th, the China Containerized Freight Index issued by Shanghai Shipping Exchange stood at 1,263.95 points; while the Shanghai Containerized Freight Index issued by SSE was reported 1,501.46 points, both almost without change against last week. Volume was almost stationary in the Europe trade, but carriers recently added more tonnage to the market, enlarging supply and demand imbalance, where the average slot utilization rate slid to around 85%. Carriers failed to carry out a rate increase in full amount in the first 10 days of May. On May 4th, the freight rates plus surcharges from Shanghai to base ports of Europe and Mediterranean issued by SSE increased 2.4% and 2.8% respectively to $1,934/TEU and $2,033/TEU. Insiders said, pushed altogether by carriers, last week saw rates went a big stride, up nearly $1,200/TEU since the end of Feb., having topped the increase amount during the same period over the years. From this point of view, most of voyages have recovered onto the break-even-point. Therefore, many lines shifted their emphasis from on the service profit to the market share expansion and started to relax tonnage supply. However, other market players expressed while demand went up clearly from Q2, its rise speed still couldn’t catch up the pace of tonnage increase as mass new ships would be delivered. If lines put lots of ships into the market, rates will face much down pressure, with the weak supply-demand relation. In the North America service, although demand continued to rise since April, the scale of tonnage climbed up obviously as some lines created sets of routes and relaxed slot booking, thus the average slot utilization rate of the USWC service declined to 90%. Hence, rates went down slightly. On May 4th, the freight index of China export to USWC route issued by SSE stood at 1,032.99 points, down 0.6% from last week. There was put less tonnage into the USEC service, so the average slot utilization rate kept above 95% and some services saw rates lift up further. The freight index of China export to USEC route issued by SSE stood at 1,259.50 points, up 0.6% from last week. Insiders said that main lines announced to lift the control over tonnage supply from the start of May, which increased the down pressure on rates and to some degree disorganized the rate rise plan from the mid-May. It is reported that many box lines have deterred to hike rates further, when to exercise the rate lift plan depending on the future market. In the Persian Gulf service, volume was in line with the level last week. Rates kept stable, with the average slot utilization rate maintaining at around 85%. On May 4th, the freight rate plus surcharges from Shanghai to base ports of the Persian Gulf issued by SSE stood at $1,603/TEU, almost no change from last week. The Australia and Singapore service saw a quiet market in demand this week, where the average slot utilization rate was just around 80%. Many lines decided to lower rates for cargo. On May 4th, the freight index of Shanghai export to Australia and Singapore route issued by SSE stood at 1,025.78 points, down 1.6% from last week. Demand continued to decline in the South America service and there was no clear contraction on tonnage supply, where rates plunged further. On May 4th, the freight index of China export to South America service issued by SSE stood at 957.94 points, down 3.6% from last week. Volume slipped a bit in the Japan service this week, with the average vessel utilization from Shanghai to Japan ports lingering at around 75%. Nevertheless, spot rates remained steady. On May 4th, the freight index of China export to Japan service issued by SSE stood at 795.50 points. |

CCFI Commentary Issue 17, 2012

| Weekly Report of China Export Container Transport Market (CCFI Commentary in Issue 17, 2012) Europe and the Mediterranean rate hike buoyed indices China export box market saw a firm-up in demand this week, with volume remaining stable on many oceangoing routes. Comprehensive indices continued to rise, supported by the rate increases in the Europe and the Mediterranean trades. On Apr. 27th, the China Containerized Freight Index issued by Shanghai Shipping Exchange stood at 1,263.10 points, significantly up 4.0% from last week; while the Shanghai Containerized Freight Index issued by SSE surged 4.3% to 1,488.14 points. Volume was almost stationary in the Europe trade, where the average slot utilization rate stood at around 90%. Spot rates of this route rose remarkably this week as most carriers will carry out a rate increase on May 1st. On Apr. 27th, the freight indices of the Europe and the Mediterranean services issued by SSE increased 3.3% and 3.2% respectively to 1,742.47 points and 1,891.79 points. In the North America service, demand was stable and the average slot utilization rate stayed at around 95%. However, rates went up and down slightly. On Apr. 27th, the freight rates plus surcharges from Shanghai to base ports of USWC and USEC issued by SSE stood at $2,414/FEU and $3,558/FEU, both barely changed from last week. It is reported that many box lines have announced to hike rates further due to the higher cost of labor and fuel bills. The latest news is that lines will push through a rate increase in mid-May, with the average increase of $400/FEU. Although lines are optimistic about the rate rise in transpacific trade, some insiders still reveal that it remains to be seen whether the increase can achieve the level lines are seeking and be sustainable, as the prevailing rates have soared significantly after several similar increases and the oversupply still exists in this marketplace. In the Persian Gulf service, volume was in line with the level last week. Spot rates soared this week as shippers rushed to export before lines raise rates on May 1st. On Apr. 27th, the freight rate plus surcharges from Shanghai to base ports of the Persian Gulf issued by SSE rose sharply by 10.4% from last week to $1,612/TEU. The Australia and Singapore service saw a modest dip in demand this week, where the average slot utilization rate was just under 80%. Rates continued to fall. On Apr. 27th, the freight rate plus surcharges from Shanghai to base ports of the Australia and Singapore issued by SSE tumbled strikingly 9.0% from last week to $1,022/TEU. Analysts told shippers’ interests in export faded after the rate increase in mid-April, thus the demand/supply situation reversed in the short run. As a response, lines are scrambling to attract shippers by reducing rates. Demand also started to decline in the South America service, where rates plunged. On Apr. 27th, the freight rate plus surcharges from Shanghai to base ports of South America issued by SSE plummeted 8.9%from last week to $1,456/TEU. Lines pushed through successive rate increases since the start of this year. However, demand failed to rise sharply and capacity couldn’t be absorbed fully. The imbalance of demand and supply made the rate develop downward. Volume slipped in the Japan service this week, with the average vessel utilization from Shanghai to Japan ports reducing to around 70%. Nevertheless, spot rates remained steady. On Apr. 27th, the freight index of the Japan service issued by SSE marked at 804.35 points, almost no change from last week. |

CCFI Commentary Issue 16, 2012

| Weekly Report of China Export Container Transport Market (CCFI Commentary in Issue 16, 2012) Demand remained stable in the China export box market this week. Comprehensive indices made correction, with the development of rates for oceangoing routes differing slightly. On Apr. 20th , the China Containerized Freight Index issued by Shanghai Shipping Exchange stood at 1,214.69 points, rose 1.3% from last week; while the Shanghai Containerized Freight Index issued by SSE marked at 1,426.23 points, almost unchanged from last week. In the Europe trade, volume didn’t change much against last week, where the average slot utilization rate stayed at around 90%, however, rates continued to spiral down. On Apr. 20th, the freight rate plus surcharges from Shanghai to base ports of Europe issued by SSE dropped 2.1% to $1,708/TEU. Market sentiments are skeptical about the range and sustainability of the rate increase on May 1st based on the following reasons. Rates have been at relatively high after lines fully implemented two rounds of rate restoration in March and April. In addition, the supply and demand situation deteriorated further. According to Clarksons, 20 boxships, or 0.194m TEU, will be delivered in May. Of these, 13 are ships above 8,000 TEU, equivalent to 0.167mTEU in terms of capacity, which made the record of deliveries of ships above 8,000 TEU in a single month. Undoubtfully, the massive new added capacity would put the rates under pressure. Furthermore, box lines shifted their focus to profitability from the fundamentals of supply and demand when they set the price. All those above made rates correct recently. However, it is sure that an export rush will come in late April because of the expected rate increase in May. Demand slightly rose in the North America service this week, boosted by the successive news of rate increase recently. Both USWC and USEC services were reported almost full-slots. Rates for boxes from Shanghai to USWC ports have gone up to $2,400/FEU after three successful rate increases from the start of this year. This compared to the $1,600/FEU in late December last year. The pick-up of rates gives lines some bargain chips when they negotiate annual service contract with shippers. On Apr. 20th, freight indices of the USWC and USEC services issued by SSE rose 2.4% and 1.9% respectively, to 993.14 points and 1,209.93 points. As retailers geared up imports to restock, the throughput of ports in the USWC soared in March. In the Australia and Singapore service, the average slot utilization rate fell below 90% as demand cooled this week. However, rates were basically stable because lines were determined to push through the rate increase on Apr. 15th. On Apr. 20th, the freight rate plus surcharges from Shanghai to base ports of the Australia and Singapore issued by SSE marked at $1,123/TEU, almost unchanged from last week. Volume inched up in Japan service this week, where the average slot utilization rate climbed above 75%. Rates remained stable. On Apr. 20th, the freight index of the Japan service issued by SSE was reported at 805.30 points, almost the same as last week. Experts now expect that some positive signs, including the recovery of manufacturing industry, the reconstruction of economy and the rising consumer spending in Japan, will effectively drive the resurgence of foreign trade and economy of this country, thus giving support to sea freight rates. |

CCFI Commentary Issue 15, 2012

| Weekly Report of China Export Container Transport Market (CCFI Commentary in Issue 15, 2012) Demand on the rise, as well as the indices China export box market generally firmed up this week, with the demand on the ocean-going routes rising moderately. The comprehensive indices continued their upward trend. On Apr. 13, the China Containerized Freight Index issued by Shanghai Shipping Exchange stood at 1,198.87 points, surged 2.0% from last week; while the Shanghai Containerized Freight Index issued by SSE rose by 3.1% to 1,416.87 points. Volume remained stable in the Europe trade this week, with the average slot utilization rate staying at around 90%. However, rates started to ease back. On Apr. 13th, the freight rate plus surcharges from Shanghai to base ports of Europe issued by SSE dropped 1.5% to $1,744/TEU. The tighter space supply in the Mediterranean trade made the average slot utilization rate of this route stay at higher 95%, and some ships leaving for East Mediterranean and Black Sea were even reportedly full-loaded. Rates for this trade kept steady. On Apr. 13th, the freight rate plus surcharges from Shanghai to base ports of Mediterranean issued by SSE marked at $1,762/TEU, almost no change from last week. Alphaliner estimates that the overall loss of the box shipping industry amounted to over $6 billion in 2011 because of the factors including overcapacity, rise of bunker cost and lower rates, resulting in most lines falling into financial troubles. To repay the debt, cope with the high oil price, maintain the business operation and pay the money of newbuildings, global lines need up to $20 billion in the short term. As the seasonal downturn of the Europe and Mediterranean comes to an end, demand is expected to return to the upward track. Furthermore,given the capacity cut measures taken by lines since the start of 2012 works, lines are planning a third general rate increase in the Asia/Europe trade, hoping this move can lift the rate revenues and help lines turn to black in Q2. It is known that many lines have announced to raise rates again since May 1st, with the increase between $300/teu-$500/teu. However, observers said the current rate level is relatively high, once the target of rate increase in May is fully achieved, rate will be over the historic peak in 2010. Given the lower percentage of idle capacity accounting for the global fleet than 2010 and the pressure brought by the large new deliveries, the supply and demand situation needs to be improved in the future. If carriers fail to control the capacity effectively in Q2, the rate increase is likely to be restrained. Demand is on the rise in the North America service. Additionally, lines pushed through several rounds of rate increase recently, which urged some shippers to export their goods ahead of schedule. Hence, volume buoyed this week, with the average slot utilization rate for the USWC service climbing above 95% and the figure for UCEC service being close to 100%. Rate remained mainly stable this week. On Apr. 13th, freight indices of the USWC and USEC services issued by SSE remained almost unchanged from last week and marked at 969.48 points and 1,187.42 points respectively. Some lines are reportedly planning to add capacity from early May in the transpacific trade to deal with the increasing demand. Driven by the rising demand, the market condition of the Australia and Singapore service was significantly improved, where the average slot utilization rate climbed above 90%. Encouraged by the big rate increase in the Asia/Europe trade, lines operating in the Australia and Singapore service announced to lift the rate again from mid April, with the increase of $200/teu. Therefore, the spot rates for this trade surged remarkably this week. On Apr. 13th, the freight rate plus surcharges from Shanghai to base ports of the Australia and Singapore issued by SSE jumped up by 14.5% from last week to $1,123/TEU. Japan service saw that volume decreased significantly, with the average slot utilization rate of service from Shanghai to Japan ports dropping to around 65%. Rates generally held up. On Apr. 13th, the freight index of the Japan service issued by SSE was reported at 809.69 points, almost the same as last week. |

lunes, 16 de abril de 2012

CCFI Commentary Issue 14, 2012

Weekly Report of China Export Container Transport Market(CCFI Commentary in Issue 14, 2012)

Strong Europe and Mediterranean services made comprehensive indices buoyant

China export box market saw that volume kept stable this week and the rise of rate in deep sea trades such as North Europe and Mediterranean routes pushed the comprehensive indices further up. On Apr. 6th, the China Containerized Freight Index issued by Shanghai Shipping Exchange stood at 1,175.71 points, surged 3.6% from last week; while the Shanghai Containerized Freight Index issued by SSE rose 2.0% to 1,374.90 points.

In Europe trade, volume didn’t change a lot this week, where the average slot utilization rate remained above 90%, and some vessels were even reported full-loaded. Most lines lifted the rates for the Europe and Mediterranean services last week, the rest of them followed suit this week, which led to a higher rate level. On Apr. 6th, the freight indices of the Europe and the Mediterranean services issued by SSE increased 6.0% and 4.6% respectively to 1,608.80 points and 1,732.98 points.

The current rate level has returned back above the breakeven point after lines boldly increased the rates several times this year. However, the rate increases were largely based on the collective moves by lines rather than the strong recovery of volume. Lines are taking every effort such as capacity management to improve the supply and demand situation, one of the key factors to decide which direction rates to move.

It was reported that some lines announced to implement super-slow steaming on the backhaul leg of Asia/Europe trade. That means containerships will be sailing at half the full speeds of 24-25 knots that were being used before the financial crash in late 2008. This move will apparently cut the real capacity on this market, then mitigating the oversupply and somewhat supporting the current rate level, if their peers take the similar measures.

Volume was steady in the North America service this week. Hence, the average slot utilization rate for the USWC and USEC services both stood at around 90%, almost unchanged from last week.

Spot rates of this trade fluctuated. On Apr. 6th, the freight rates plus surcharges from Shanghai to base ports of USWC and USEC issued by SSE stood at $2,028/FEU and $3,207/FEU, both barely changed from last week.

It is reported that lines will hike transpacific rates up on Apr.15 following the last rate increase in March, with the average increase of $400/FEU. Some insiders analyze that lines do so to lift the contract rates level before May when annual service contract negotiations of U.S. trade are in progress.

As volume leveled off in the Australia and Singapore service this week, rates eased back. On Apr. 6th, the freight rate plus surcharges from Shanghai to base ports of the Australia and Singapore issued by SSE tumbled slightly by 0.7% from last week to $981/TEU.

The South America route saw a drop both in volume and rate. On Apr. 6th, the freight rate plus surcharges from Shanghai to base ports of South America issued by SSE dipped 1.0%from last week to $1,499/TEU.

Since the beginning of this year, rates have gone up remarkably in this marketplace, but the limited growth of volume and insignificant shrink of capacity gave little support to rates that dropped recently.

There was a small increase in volume in Japan service this week, with the average vessel utilization from Shanghai to Japan ports standing at just over 75%. Spot rates went flat this week. On Apr. 6th, the freight index of the Japan service issued by SSE marked at 809.27 points, down 0.7% against last week.

Strong Europe and Mediterranean services made comprehensive indices buoyant

China export box market saw that volume kept stable this week and the rise of rate in deep sea trades such as North Europe and Mediterranean routes pushed the comprehensive indices further up. On Apr. 6th, the China Containerized Freight Index issued by Shanghai Shipping Exchange stood at 1,175.71 points, surged 3.6% from last week; while the Shanghai Containerized Freight Index issued by SSE rose 2.0% to 1,374.90 points.

In Europe trade, volume didn’t change a lot this week, where the average slot utilization rate remained above 90%, and some vessels were even reported full-loaded. Most lines lifted the rates for the Europe and Mediterranean services last week, the rest of them followed suit this week, which led to a higher rate level. On Apr. 6th, the freight indices of the Europe and the Mediterranean services issued by SSE increased 6.0% and 4.6% respectively to 1,608.80 points and 1,732.98 points.

The current rate level has returned back above the breakeven point after lines boldly increased the rates several times this year. However, the rate increases were largely based on the collective moves by lines rather than the strong recovery of volume. Lines are taking every effort such as capacity management to improve the supply and demand situation, one of the key factors to decide which direction rates to move.

It was reported that some lines announced to implement super-slow steaming on the backhaul leg of Asia/Europe trade. That means containerships will be sailing at half the full speeds of 24-25 knots that were being used before the financial crash in late 2008. This move will apparently cut the real capacity on this market, then mitigating the oversupply and somewhat supporting the current rate level, if their peers take the similar measures.

Volume was steady in the North America service this week. Hence, the average slot utilization rate for the USWC and USEC services both stood at around 90%, almost unchanged from last week.

Spot rates of this trade fluctuated. On Apr. 6th, the freight rates plus surcharges from Shanghai to base ports of USWC and USEC issued by SSE stood at $2,028/FEU and $3,207/FEU, both barely changed from last week.

It is reported that lines will hike transpacific rates up on Apr.15 following the last rate increase in March, with the average increase of $400/FEU. Some insiders analyze that lines do so to lift the contract rates level before May when annual service contract negotiations of U.S. trade are in progress.

As volume leveled off in the Australia and Singapore service this week, rates eased back. On Apr. 6th, the freight rate plus surcharges from Shanghai to base ports of the Australia and Singapore issued by SSE tumbled slightly by 0.7% from last week to $981/TEU.

The South America route saw a drop both in volume and rate. On Apr. 6th, the freight rate plus surcharges from Shanghai to base ports of South America issued by SSE dipped 1.0%from last week to $1,499/TEU.

Since the beginning of this year, rates have gone up remarkably in this marketplace, but the limited growth of volume and insignificant shrink of capacity gave little support to rates that dropped recently.

There was a small increase in volume in Japan service this week, with the average vessel utilization from Shanghai to Japan ports standing at just over 75%. Spot rates went flat this week. On Apr. 6th, the freight index of the Japan service issued by SSE marked at 809.27 points, down 0.7% against last week.

jueves, 29 de marzo de 2012

CCFI Commentary in Issue 10, 2012

Weekly Report of China Export Container Transport Market

Export demand kept stable, pushing rate up in some trades

Volume remained stable on the China export box market this week. Comprehensive index rose, but the performance of component services varied.

On Mar. 9th, the China Containerized Freight Index issued by Shanghai Shipping Exchange stood at 1,002.71 points, surged 6.4% from last week; while the Shanghai Containerized Freight Index issued by SSE stood at 1,170.57 points, almost no change from last week.

In the Asia/Europe trade lane, volume barely changed and the average slot utilization rate stayed at around 90% this week when it came into the second week since lines carried out the rate rise plan at the beginning of this month.

As the relatively huge rate increase, no substantial volume growth and few capacity cut, the situation that supply outpaces demand has yet to change, and rate started to drop again. However, rate drop restrained this week due to the insistence of lines to hold up the rate. On Mar. 9th, the freight rate plus surcharges from Shanghai to base ports of Europe issued by SSE tumbled 1.7% to $1,388/TEU.

Although the rate hike, effective on Mar.1st, made the biggest growth ever, insiders told the increased rate could just meet the idle expenditure, but still under the breakeven point of lines. It was said that some lines had announced to lift rate again in April.

Space supply was stable this week in the North America service. Volume rose moderately as shippers wanted to secure their cargo on board when they heard that lines would raise rate on Mar.15th. The average slot utilization rate for the USWC and USEC services both went up to around 95%. Despite the firm demand, rate continued to inch down ahead of the rate rise. On Mar. 9th, the freight rates plus surcharges from Shanghai to base ports of USWC and USEC issued by SSE stood at $1,753/FEU and $2,914/FEU, respectively lost 0.3% and 0.1% from last week.

MSC planned to deploy two mega ships, one 12,500 teu vessel and one 11,600 teu vessel, in this trade lane, which means lines started to upgrade the capacity in Pacific, putting a great challenge for market to absorb capacity.

In the Australia and Singapore trade lane, rate soared near the middle of the month and volume elevated this week, with the average slot utilization rate back to around 90%. Rate started to pick up as some lines carried out rate hike. On Mar. 9th, the freight rate plus surcharges from Shanghai to base ports of the Australia and Singapore issued by SSE jumped up 3.6% from last week to $744/TEU.

Demand remained sluggish this week in the South America trade, where the average slot utilization rate lingered at 70% or so. However, the news that some carriers would lift rate shortly slowed the rate decline. On Mar. 9th, the freight rate plus surcharges from Shanghai to base ports of South America issued by SSE tumbled 1.5% against last week to $1,271/TEU, compared to the decline of 4.8% last week.

In the Japan service, volume kept steady this week, where the average slot utilization rate marked at around 70%. It was reported that some lines started to levy $100/teu of General Bunker Floating (GBF) this week, which somewhat boosted the average rate level. On Mar. 9th, the freight index of the Japan service issued by SSE was reported at 762.78 points.

Export demand kept stable, pushing rate up in some trades

Volume remained stable on the China export box market this week. Comprehensive index rose, but the performance of component services varied.

On Mar. 9th, the China Containerized Freight Index issued by Shanghai Shipping Exchange stood at 1,002.71 points, surged 6.4% from last week; while the Shanghai Containerized Freight Index issued by SSE stood at 1,170.57 points, almost no change from last week.

In the Asia/Europe trade lane, volume barely changed and the average slot utilization rate stayed at around 90% this week when it came into the second week since lines carried out the rate rise plan at the beginning of this month.

As the relatively huge rate increase, no substantial volume growth and few capacity cut, the situation that supply outpaces demand has yet to change, and rate started to drop again. However, rate drop restrained this week due to the insistence of lines to hold up the rate. On Mar. 9th, the freight rate plus surcharges from Shanghai to base ports of Europe issued by SSE tumbled 1.7% to $1,388/TEU.

Although the rate hike, effective on Mar.1st, made the biggest growth ever, insiders told the increased rate could just meet the idle expenditure, but still under the breakeven point of lines. It was said that some lines had announced to lift rate again in April.

Space supply was stable this week in the North America service. Volume rose moderately as shippers wanted to secure their cargo on board when they heard that lines would raise rate on Mar.15th. The average slot utilization rate for the USWC and USEC services both went up to around 95%. Despite the firm demand, rate continued to inch down ahead of the rate rise. On Mar. 9th, the freight rates plus surcharges from Shanghai to base ports of USWC and USEC issued by SSE stood at $1,753/FEU and $2,914/FEU, respectively lost 0.3% and 0.1% from last week.

MSC planned to deploy two mega ships, one 12,500 teu vessel and one 11,600 teu vessel, in this trade lane, which means lines started to upgrade the capacity in Pacific, putting a great challenge for market to absorb capacity.

In the Australia and Singapore trade lane, rate soared near the middle of the month and volume elevated this week, with the average slot utilization rate back to around 90%. Rate started to pick up as some lines carried out rate hike. On Mar. 9th, the freight rate plus surcharges from Shanghai to base ports of the Australia and Singapore issued by SSE jumped up 3.6% from last week to $744/TEU.

Demand remained sluggish this week in the South America trade, where the average slot utilization rate lingered at 70% or so. However, the news that some carriers would lift rate shortly slowed the rate decline. On Mar. 9th, the freight rate plus surcharges from Shanghai to base ports of South America issued by SSE tumbled 1.5% against last week to $1,271/TEU, compared to the decline of 4.8% last week.

In the Japan service, volume kept steady this week, where the average slot utilization rate marked at around 70%. It was reported that some lines started to levy $100/teu of General Bunker Floating (GBF) this week, which somewhat boosted the average rate level. On Mar. 9th, the freight index of the Japan service issued by SSE was reported at 762.78 points.

lunes, 5 de marzo de 2012

China cuts GDP growth to 7.5 pct in 2012

Mar,5 -- China sets its GDP growth target at 7.5 percent this year, down from 8 percent in 2011, according to a government work report to be delivered by Premier Wen Jiabao at the parliament's annual session Monday.

This is the first time for the Chinese government to lower its economic growth target after keeping it around 8 percent for seven consecutive years.

"Here I wish to stress that in setting a slightly lower GDP growth rate, we hope to make it fit with targets in the Twelfth Five-Year Plan, and to guide people in all sectors to focus their work on accelerating the transformation of the pattern of economic development and making economic development more sustainable and efficient, so as to achieve higher-level, higher-quality development over a longer period of time," reads the report which was distributed to the media.

Previously, China has announced to target a 7 percent GDP growth from 2011 to 2015, the country's 12th Five-Year Plan period.

China's economy expanded by 9.2 percent in 2011 to 47.16 trillion yuan (about 7.49 trillion U.S. dollars) from a year earlier after it grew 10.3 percent in 2010. In the fourth quarter last year, the country's GDP growth decelerated to 8.9 percent year-on-year, the slowest pace in 10 quarters.

The government has set the main theme of this year's economic and social development as "make progress while maintaining stability" at a tone-setting central economic work conference in December last year.

China will continue to follow a proactive fiscal policy and a prudent monetary policy, carry out "timely and appropriate anticipatory adjustments and fine-tuning", and make its policies "more targeted, flexible, and anticipatory", according to the report.

"To achieve steady growth, we will continue to expand domestic demand and keep foreign demand stable, vigorously develop the real economy, work hard to counter the impact of various factors of instability and uncertainty at home and abroad, promptly resolve emerging issues that signal unfavorable trends, and maintain stable economic performance," reads the report.

The Chinese government has set the aim to hold this year's consumer price growth at around 4 percent. The country's consumer price index (CPI), a main gauge of inflation, rose 4.5 percent year-on-year in January, down from a 37-month high of 6.5 percent in July last year.

(Source:Xinhuanet)

This is the first time for the Chinese government to lower its economic growth target after keeping it around 8 percent for seven consecutive years.